We have been hearing this question often in recent weeks, “How are the markets going to react to the presidential election?” Although we tend to hear this question every presidential election, it seems to be coming up more often this time. Perhaps that is because many people have strong negative views of one candidate or another, or both. The latest Real Clear Politics average of polls shows Hilary Clinton with a -9.5 Favorable to Unfavorable ratio (43.6/53.1) while Donald Trump’s stands at -20.6 (37.8/58.4). The country seems to be regarding this election like a Thursday Night Football matchup with two bad teams, but by rule somebody has to win. Although the position of President of the United States is a very important one, I hope to lay out a case of why you shouldn’t panic by making drastic changes to your long-term retirement plan if you aren’t happy with the outcome of this election.

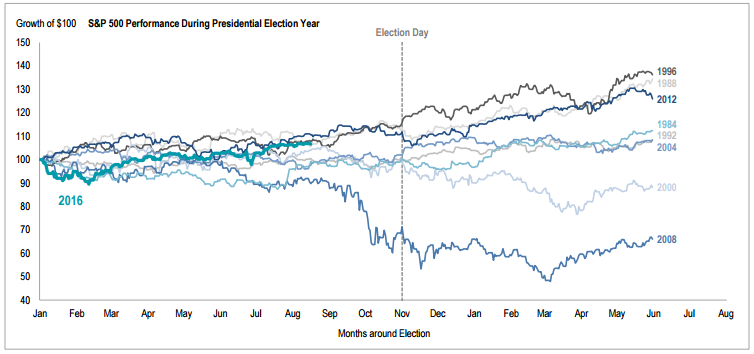

First, markets tend to like certainty. Businesses can make their plans if they know what to expect. Even if there are obstacles in the way, business leaders can adapt and work around these obstacles if they know what they are. But uncertainty in any form makes planning more difficult. Just having the election decided, regardless of outcome, removes some uncertainty. The candidate’s statements can be a guideline of what likely policies they hope to create. For some historical data, the chart below shows the S&P 500 performance during election years and into the follow year for the eight most recent presidential elections. In most of these cycles, the period following the election was positive for various candidates are parties. The exceptions were 2000 and 2008 when economic recessions held a much larger weight on the market than the results of the election.

Second, most of the policies that affect markets are created by the legislature with the President’s endorsement. Although many Americans complain about the gridlock in Washington, the checks and balances of the three branches of government provide a safeguard against one person rearranging all of the policies as they see fit. This process can get ugly, but in the end it is a process of compromise.

Lastly, the economy is affected by many factors, and government policy is one of them. But in the end, it is only one of many factors. Interest rates, consumer spending, productivity gains through technology, oil prices, global currency fluctuations, and employment all have an impact on the economy. All business hope to stay in business next year, no matter who is the President. Apple will still be trying to sell iPhones, Ford will still be selling trucks, and scammers will still be calling from unknown phone numbers at all times of the day or night trying to lower your credit card payments.

The economy is shaped much more by businesses and consumers deciding what products and services to produce and consume than the other factors that we tend to give too much credit. Who the President is can make a difference, but not nearly as much as we think.