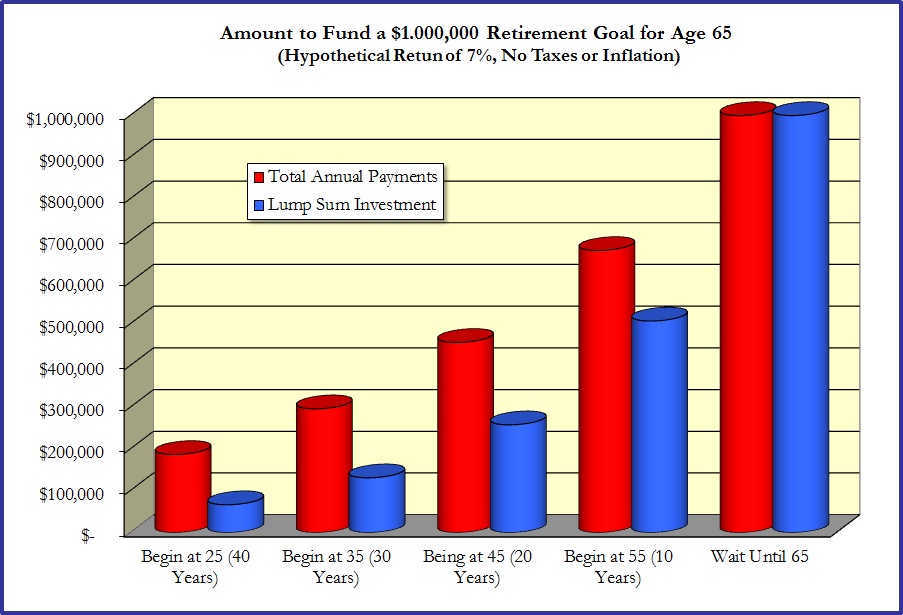

How Much Does $1,000,000 Cost?

Our retirement income will be based on an amount that we need to accumulate, just as we might accumulate an amount for a car or a home. Here are a few different approaches, which all share the following assumptions:

- Accumulation Goal is $1,000,000.

- Retirement Age is 65.

- Investment Return is 7% per year (based on historical returns, this would require about a 60% allocation to a broadly diversified stock portfolio with the balance in bonds and other fixed income holdings. This is based on historical returns that will not repeat in the future.)

- To simplify, no consideration is given to inflation and taxes. (Including the impact of taxes and inflation would increase the required annual investment.)

- Investor will behave appropriately (as described below.)

Some sample options would be:

- Lump sum purchase at retirement; pretty much impossible.

- Fund over 10 years (begin age 55). Annual investment would be $67,643 for a total of $676,430, or a one-time lump sum payment of $507,350.

- Fund over 20 years (begin age 45). Annual investment would be $22,798 for a total of $455,960, or a lump sum payment of $258,419.

- Fund over 30 years (begin age 35): Annual investment would be $9,894 for a total of $296,820, or a lump sum payment of $131,367.

- Fund over 40 years (begin age 25): Annual investment would be a mere $4,681 for a total of $187,240, or a lump sum payment of only $66,780.

To behave “appropriately”, an investor would need to:

- Stay committed to the annual funding commitment and adjust the contribution based on changes in inflation rates, actual investment returns, significant long-term economic changes and/or changes in your personal circumstances.

- Stay in the investment market even when it goes down and rebalance the portfolio at optimum times (not just annually or quarterly).

- Monitor tax rates and make the most of various investment vehicles and strategies (401k, IRAs, Roth IRAs, taxable accounts, loss and gain capturing) to minimize the drain on the investment returns from taxes.

Similar discipline is also required during the retirement distribution period of our lives, but that’s a topic for a future blog post.