Making “Simple” Easier

Most things in life are simple. They’re just not always easy.

Take losing weight, for example. Most of us only have to eat less and we’ll lose weight. Simple? Absolutely! Easy? If it were, the rate of US obesity wouldn’t be so high.

How about getting in shape? Again, it’s simple: Exercise 30 to 60 minutes five days a week. Easy? Absolutely not!

How about reaching an important financial goal, like retirement? It’s simple:

- Spend less

- Save wisely for rainy days

- Avoid unnecessary debt

- Invest consistently and prudently

- Buy appropriate insurance when needed

Simple, yes! Easy? Not quite.

According to the most recent Retirement Confidence Survey conducted by the Economic Benefit Research Institute, only 28% of workers reported they were very confident they would have enough money to take care of their basic expenses during retirement.

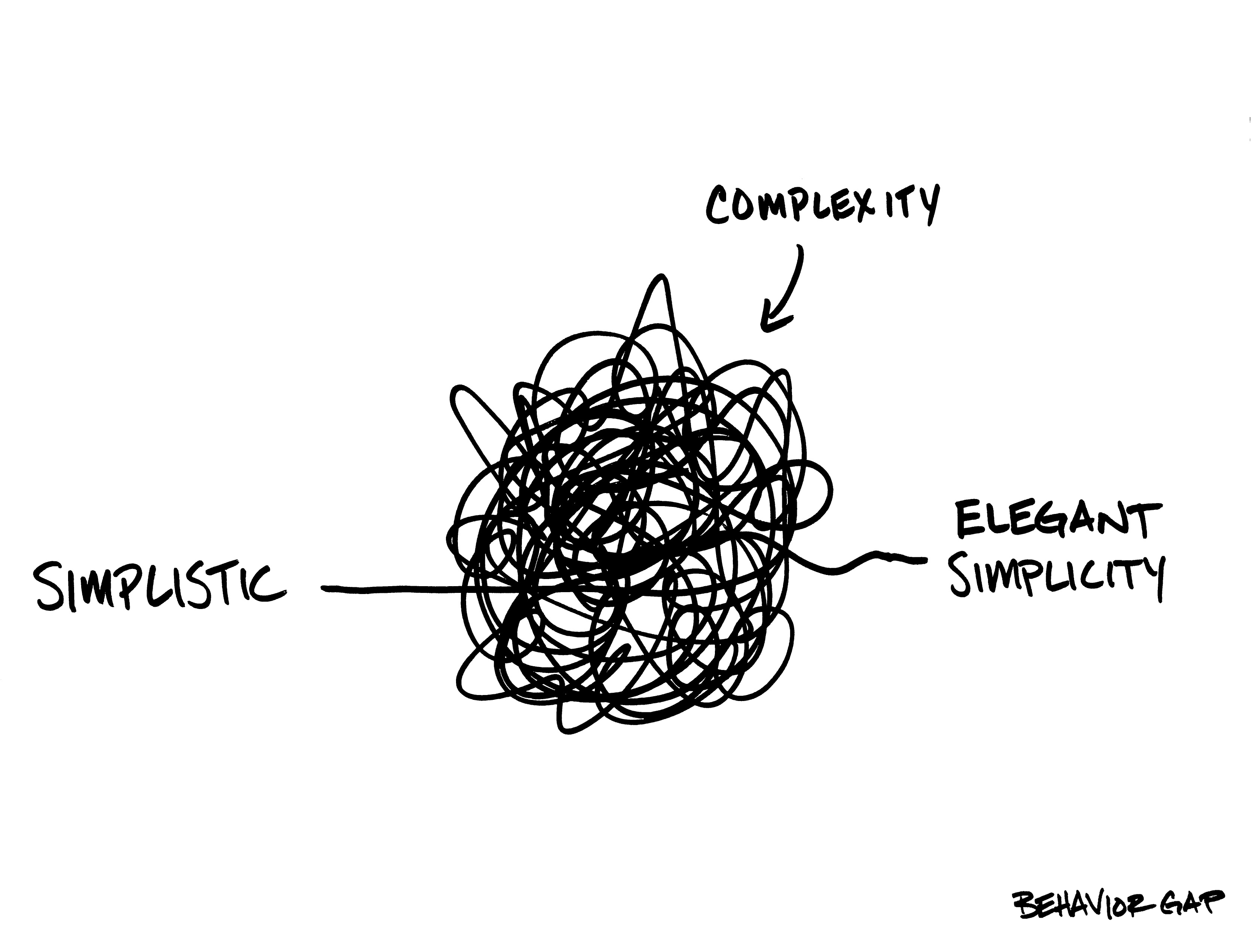

Many times we don’t reach our goals because we make the process too complex. We adopt fad diets when reducing portion sizes would give the same benefits. We buy expensive exercise equipment or gym memberships instead of taking walks. We invest in overly risky and complex investment strategies in a vain shot for high returns instead of sticking to investment basics. While having a complex or risky strategy may give us bragging rights at the country club or family reunions, it may do nothing to help us achieve our goals!

Here are some tips to help you reach your important lifestyle and financial goals easier:

- Automate repetitive steps. Sometimes it’s hard to have the willpower to prepare a monthly check for savings or investing when we have other short-term wants. Using automatic savings and investing plans (such as 401ks and related plans or automatic payroll withholding) lets us make the decision to save once—when we set up the plan, instead of each month or with each paycheck. The same goes for paying debt. Payments should be pulled from your checking account automatically each month so you won’t be tempted to spend on something else less important.

- Focus on the controllable and ignore what’s not. We can’t control what happens in the investment markets. When we try to control the returns (for example, through trying to time the markets or investing speculatively) we often make things worse. We can control how much we invest regularly and how long we leave it invested. Investment markets are volatile, but slow and steady long-term investing in a broadly diversified portfolio, rebalanced regularly, can reduce the potential damage from that volatility.

- Get help when needed. Competent objective advice is essential, particularly when you’re trying to reach essential lifestyle and financial goals. Some financial tasks should be delegated, not because you can’t learn to do them yourself, but so you can do more important things (like that daily walk!) A good resource for a fee-only advisor is the National Association of Personal Financial Advisors (www.napfa.org). Other resources include the CFP Board (www.cfpboard.com) and the Financial Planning Association (www.fpanet.org).

- Most importantly, start now! The longer you wait to start working towards your goal, the harder it will be to achieve it.