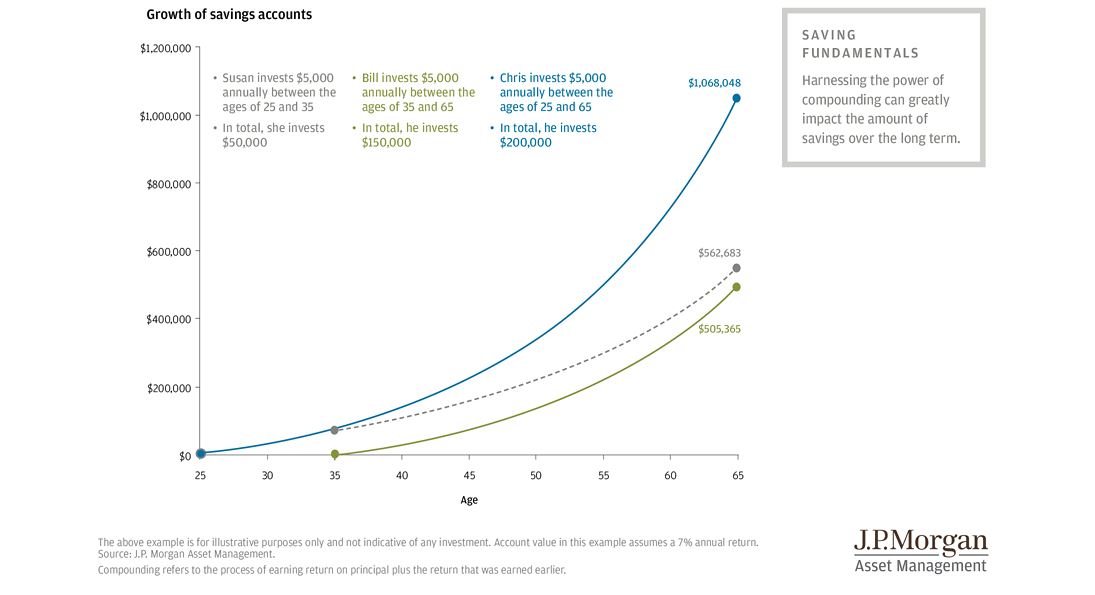

Compounding interest is a beautiful thing. Albert Einstein called it, “the greatest mathematical discovery of all time.” Compounding gives power to patient and disciplined investors to improve their lives, and their families, for the better. The basic formula for compounding gains has three main variables: dollars invested, rate of return, and time. While the